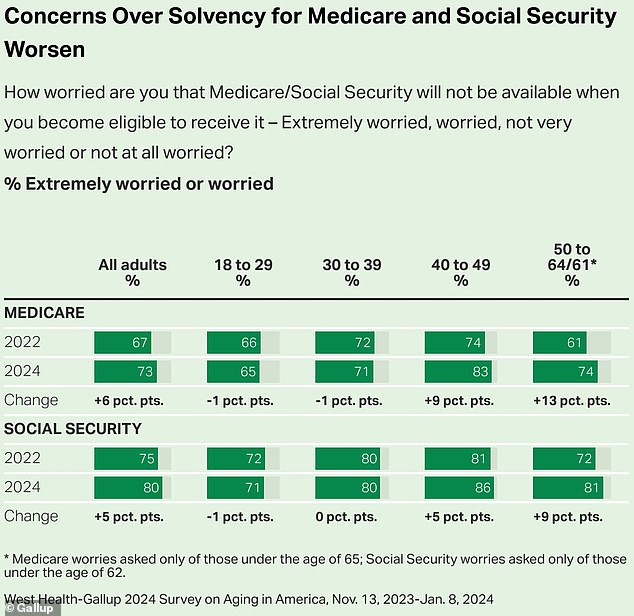

Americans are increasingly alarmed that Medicare and Social Security will collapse by the time they retire, a poll shows.

About three-quarters of adults are ‘concerned’ or ‘extremely concerned’ about losing publicly funded health care in their prime, pollster Gallup says.

Four-fifths of them fear the dismantling of Social Security, the poll says.

The number of people who are alarmed has increased in the last couple of years – and those approaching retirement age are the most worried of all.

The survey comes as America’s safety net unravels, with an aging population and not enough workers paying taxes to support the system.

Those closer to retirement are the most worried about running out of funds, polls show.

About three-quarters of adults are worried about losing publicly funded health care in their prime, Gallup says.

The latest data shows that the funds that support Social Security and Medicaid could dry up in just over a decade.

Fears about cash-strapped pensions were highlighted this week by a 90-year-old US Air Force veteran who pushes shopping carts at a grocery store in sweltering Louisiana to make ends meet.

Dillon McCormick’s $1,100 in Social Security payments aren’t enough to retire on.

Dillon McCormick’s $1,100 in Social Security payments aren’t enough for him to retire, he says.

Thousands of people donated nearly a quarter of a million dollars to an online fundraiser to help McCormick quit his demanding job at the Winn-Dixie grocery store in the New Orleans suburb of Metairie.

“Americans don’t take for granted that Medicare and Social Security will always be there for them,” Gallup says.

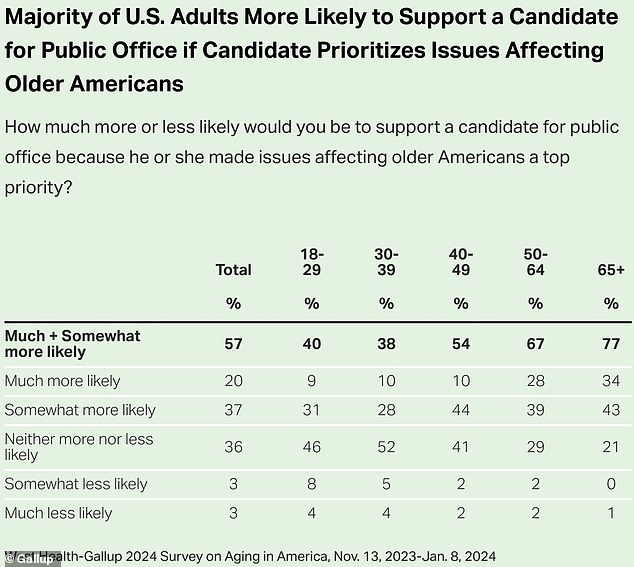

The poll says ‘older voters, who typically vote at high rates’, are the most worried and may vote accordingly in the November election.

“Such sentiment could serve as a wake-up call to action” for lawmakers, they said in a report.

Social Security relies on its trust funds to provide monthly benefit checks to about 70 million Americans.

Fears about cash-strapped pensions were highlighted this week by the case of a 90-year-old US Air Force veteran who pushes shopping carts at a grocery store in sunken Louisiana to make ends meet.

Fears about a cash-strapped retirement were highlighted by Dillon McCormick, 90, a US Air Force veteran who pushes shopping carts at a grocery store in waterlogged Louisiana to make ends meet.

Martin O’Malley, Social Security Commissioner, urged Congress to take steps to ‘extend the financial health of the Trust Fund into the foreseeable future’

Thousands of people donated nearly a quarter of a million dollars to an online fundraiser to help Dillon McCormick retire from his demanding job at the Winn-Dixie grocery store in the New Orleans suburb of Metairie.

But an aging population is driving up the cost of the program as fewer people are paying into it and expenses outpace revenues.

In what has been called the ‘silver tsunami’, about 4.1 million Americans will turn 65 in 2024, and every year through 2027, according to a report by the Alliance for Living Income.

An annual report from the Social Security Administration Board last month found that Social Security will only be able to pay full benefits for the next 11 years.

Social Security is funded primarily through payroll taxes that are taken out of paychecks – which are then used to pay retirement and disability benefits.

If the trust funds that the Social Security Administration relies on are depleted, that doesn’t mean the payments will suddenly disappear.

Instead, Trustees say beneficiaries will face cuts to their monthly checks — losing 17 percent of their current benefits.

This could be significant for millions of Americans with disabilities and those who rely on Social Security as their only income in retirement.

According to the Peter G. Peterson Foundation, a nonpartisan research group, an automatic 21 percent cut would hit all beneficiaries in just nine years.

That adds up to nearly $17,000 a year for the average couple, a new report says.

Michael Peterson, the group’s CEO, warned that Social Security “is on a fast track to bankruptcy.”

“Voters want leaders to prioritize solutions to prevent devastating cuts to this essential program,” he added.

Meanwhile, Medicare, which provides health insurance for people age 65 and older, will see its reserves depleted by 2036, the researchers said.

This is partly due, the report says, to higher payroll tax revenues and lower expenditures than projected for 2023.

Social Security relies on its trust funds to provide monthly benefit checks to about 70 million Americans

Retirement fears could affect how people vote in November

The uncertain path to Social Security and Medicare has been a concern for many — especially those nearing retirement age.

A full 73 percent of all adults worry that Medicare will disappear in the next few years, and 80 percent think the same about Social Security, the Gallup poll shows.

Voters are 57 percent more likely to support a political candidate who prioritizes the budgets of older Americans in the election, the poll found.

The nationwide survey of 5,149 adults was conducted between November 2023 and January 2024.

The financial perspective of the social security system has long been a point of political contention.

Republicans have suggested raising the retirement age, while Democrats have offered raising the cap on payroll taxes as a possible solution.

Some experts warn that politicians are running away from the problem rather than trying to fix it – and it is crucial that they act now.

Earlier this year, billionaire CEO Larry Fink said Americans must work beyond age 65 to stop the collapse of the Social Security system.

“No one should have to work longer than they want to,” Fink wrote in his 2024 letter to shareholders.

“But I think it’s a little crazy that our anchor idea of the right retirement age — 65 — dates back to the time of the Ottoman Empire.”

Martin O’Malley, the Social Security commissioner, urged lawmakers to act now to shore up empty trusts.

#Americas #retirement #apocalypse #17000ayear #hole #budget #Social #Security #Medicare #explode

Image Source : www.dailymail.co.uk