The wearables market grew 8.8% in the first quarter of 2024 compared to the first quarter of last year. However, the market continues to shift towards cheaper models as this was the fifth consecutive quarter of average selling price (ASP) decline.

This information comes from IDC’s quarterly worldwide wearable device tracker. Analysts say consumers don’t see much sense in spending extra money on premium models and mostly stick to mid-range and entry-level devices, hence the falling ASP.

But once advanced sensors, those that can measure blood pressure or glucose, hit the market, things will change and we may see premium models grow in popularity. Meanwhile, small regional brands are experiencing a peak as their low-cost offerings enjoy a period of popularity.

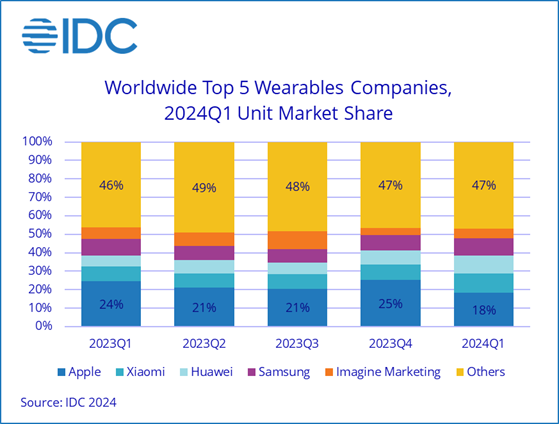

Looking at individual brands, Apple is still the top dog, but its market share has shrunk significantly (down almost 19% year-over-year). Analysts blame sales bans and subsequent feature removals for the disruption, but it’s also partly Apple’s fault. The wearables segment also includes headphones, not just smartwatches, and when was the last time Apple launched new headphones? The third generation of AirPods came out at the end of 2021 and the second generation of AirPods Pro at the end of 2022. The AirPods Max are even older and come from 2020.

Xiaomi is growing fast and has grown almost 44% year-on-year. The company always has fresh affordable products, but its return to Wear OS was also quite successful – according to IDC, Xiaomi is now the third largest manufacturer of Wear OS.

Huawei knocked Samsung out of third place – attributed to the company’s resurgence in the smartphone business, which apparently boosted the fortunes of its wearables division as well.

As for Samsung, the Galaxy Fit3 proved popular thanks to its lower price, but its success wasn’t enough to offset the drop in sales of the Galaxy Watch. At least not enough to keep Huawei ahead. On the plus side, Samsung’s 13% Q1 growth is still better than the industry average of 8.8%.

Fifth place is held by Imagine Marketing – you may not have heard of it, but you may have heard of its “boAt” brand. Their headphones are doing well (up 17.5%), but smartwatches fell off a cliff (down 61.3%).

| Top 5 wearables companies by shipment volume, market share and year-over-year growth, Q1 2024 (shipments in millions) | |||||

|---|---|---|---|---|---|

| company | 1Q24 Shipments | 1 T24 Market Share | 1Q23 Shipments | 1 T23 Market Share | Growth from year to year |

| 1. Apple | 20.6 | 18.20% | 25.4 | 24.50% | -18.90% |

| 2. Xiaomi | 11.8 | 10.5% | 8.2 | 7.9% | 43.4% |

| 3. Huawei | 10.9 | 9.6% | 6.3 | 6.1% | 72.4% |

| 4. Samsung | 10.6 | 9.3% | 9.4 | 9.0% | 13.0% |

| 5. Imagine Marketing | 6.1 | 5.4% | 6.4 | 6.2% | -4.8% |

| Others | 53.1 | 46.9% | 48.2 | 46.4% | 10.1% |

| In total | 113.1 | 100.0% | 104 | 100.0% | 8.8% |

| Source: IDC Worldwide Quarterly Wearables Tracker, June 4, 2024 | |||||

spring

#IDC #Wearables #market #grows #buyers #focus #cheaper #models

Image Source : www.gsmarena.com