Mexico’s presidential election took place on Sunday (June 2), with far-reaching implications for the natural gas market. For long-term trends in Mexico’s natural gas market, NGI reviewed some of the first quarter 2024 earnings calls of major players in the industry.

As for a more recent update, Claudia Sheinbaum of the Morena party won the presidency by a landslide. Natural gas imports from the United States are expected to continue to rise under Sheibaum six years, or a six-year term, and it is expected that the state utility Comisón Federal de Electricidad (CFE) will maintain its control over the development of the supply infrastructure over private industry. Industry expert Eduardo Prud’homme recently told NGI on an episode of Hub & Flow that there will likely be “no dramatic change” from the previous administration.

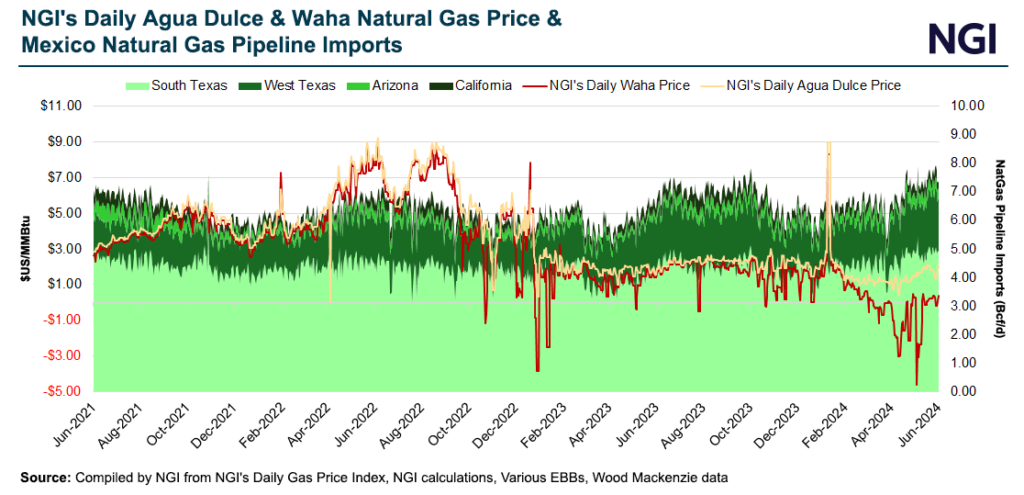

Sempra (SRE) – Sempra CEO Jeffery Martin said that Mexico is “a market with over 130 million consumers. When I became CEO in 2018, it was the 15th largest economy in the world. Today, you [International Monetary Fund] ranked it as no. 12 economy in the world and PricewaterhouseCoopers now predicts it will be no. 7 in the world by 2040. It is also our largest trading partner with an energy grid that is highly integrated with the United States.” NGI estimates that US gas exports to Mexico could increase from 6 Bcf/d in 2023 to 9 Bcf/d in 2030.

Meanwhile, Energía Costa Azul LNG Phase 1 is approximately 80% complete and remains on target to begin commercial operations in the summer of 2025.

TC Energy Corp. (TRP) – Projects continued to progress in Southern Mexico. TC Energy noted the offshore pipeline installation for its 1.3 Bcf/d Southeast Gateway project is now more than 70% complete and remains on schedule for an in-service date of 2025. TC Energy Management noted weather seems to be the main risk. The National Oceanic and Atmospheric Administration (NOAA) predicts eight to 13 hurricanes and between 17 and 25 named storms between June 1 and November 30, which is above normal. TC Energy also mentioned that the southern section of the Villa de Reyes pipeline is targeted for mechanical completion in the second half of 2024, and Engie SA announced that it is increasing capacity on the Mayakan Pipeline in the Yucatan Peninsula.

Oneok Inc. (OK) – On the other hand, Oneok management did not mention the Saguaro Connector during the prepared commentary for the 1Q2024 earnings call. The project last appeared in the company’s January 2024 investor relations (IR) update. It was not in the March 2024 IR update, nor in the 1Q2024 earnings slide deck. In its 2023 10-K filing, Oneok mentioned that the final investment decision (FID) on the Saguaro Connector pipeline is expected by mid-2024, which is just four weeks from now. The absence of any reference to the Saguaro Pipeline in Oneok’s materials is noteworthy, as IR presentations are sales documents that are designed to highlight any positive developments and opportunities that could have a material impact on the stock price in the future. Furthermore, no one from the sell-side analyst community asked about it during the 1Q2024 call. Perhaps this was a mistake, or perhaps Oneok still expects Saguaro to achieve positive FID, but no longer believes it would have a material impact on its financials. It could also be a case of Mexico Pacific pushing its own FID. Regardless, the lack of mention of this project is somewhat curious.

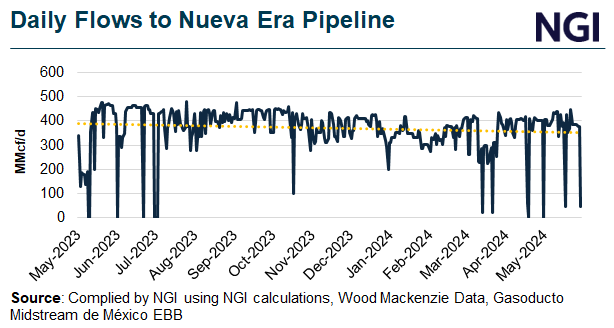

Silverbow Resources Inc. (SBOW) – It’s rare to hear a company explain why a proposed merger didn’t go through, unless it was a hostile takeover, or there was just a massive change of heart. The latter certainly appears to be the case at the now-defunct Silverbow Energy-Kimmeridge Energy Management Co. LLC connection. In case you missed it, Silverbow eventually agreed to tie up with Houston-based Crescent Energy Co . But regarding the failed Kimmeridge Texas Gas LLC (KTG) merger, Silverbow CEO Sean Woolverton said, “one of the things we struggled with with the KTG proposal is that we didn’t drill gas in Webb County or limited quantities for the last two years. It just doesn’t compete for capital in a $2.50 world. In fact, I think KTG is one of the only companies out there drilling theirs.” Webb County, TX is the main feeder area for the Nueva Era Pipeline serving Monterrey.As shown in the chart below, pipeline scratches in Mexico are not always reliable given the number of zero days – although it is certainly possible that there have been operational problems even in those zero days – and, secondly, gas flows in the Nueva era have been in a slight decline since May 2023. A reduction in drilling in Webb County is probably not likely to help the issues.

The total average number of devices in Latin America reached 167 in 1Q2024, down 11 y/y. However, there are three countries where the number of annual devices/year has increased by more than one – Mexico (plus 10), Brazil (plus five) and Venezuela (plus two). Venezuela is twice as high because there are now two rigs there, compared to none a year ago. Mexico is ramping up its oil exploration, but that’s likely to be its primary goal, as the country is using zero targeted gas rigs. The country continues to rely on US imports and associated gas production. Same story in Brazil, which is also 100% oil focused. Argentina has shed nine oil-driven rigs y/y, but is the only country in Latin America to see an increase in gas-focused activity, with three more rigs in the first quarter of 2024 than a year ago before. Activity is expected to increase there, as Nabors Industries Ltd. is sending over three platforms to the country, two platforms in 2024 and another next year. Argentina is also experiencing one of its coldest winters in 50 years, which is likely to support natural gas-focused drilling as well.

Also, developments in Suriname may be important moving forward. There were no rigs operating there during 1Q2024, but APA Corp. expects to reach an FID later this year. Sergio Chapa of Poten Partners noted at an industry conference earlier in May that Suriname could become an exporter of liquefied natural gas over time.

#NGIs #1Q2024 #Mexico #Natural #Gas #Market #Analyst #Natural #Gas #Intelligence

Image Source : www.naturalgasintel.com