You could lose money by maxing out your 401(k) plan early — unless it has this special feature

Sally Anscombe | Moment | Getty Images

When saving for retirement, investing sooner usually increases growth over time. But you can lose money by maxing out your 401(k) too early in the year — unless the plan has a special feature.

Most 401(k) plans offer an employer match, which uses a formula to deposit additional money into the account based on your deferrals. Typically, you must contribute at least a certain percentage of income for each paycheck to receive the full employer match of the year.

However, some 401(k) plans offer a “true finish,” or additional deposit of the remaining employer match, to employees who max out contributions before the end of the year.

More from Personal Finance:

Average 401(k) savings rates recently hit a record — here’s what experts suggest

Investor home purchases rise for the first time in two years

5 ways to maximize your vacation days

“It’s a tremendous benefit,” but not all 401(k) plans offer a reality, said Tommy Lucas, a certified financial planner and enrolled agent at Moisand Fitzgerald Tamayo in Orlando, Florida.

To that point, roughly 67% of plans offering more than annual matches did in 2022, according to the Plan Sponsors Council of America’s latest annual survey. It’s usually more common on larger plans, experts say.

No truth can be an ‘absolute nightmare’

When a 401(k) doesn’t have one, “it’s an absolute nightmare” because employees can easily lose a portion of the company match, Lucas said.

For example, let’s say you’re under the age of 50, earning $200,000 a year, and your company offers a 5% 401(k) match without real proof.

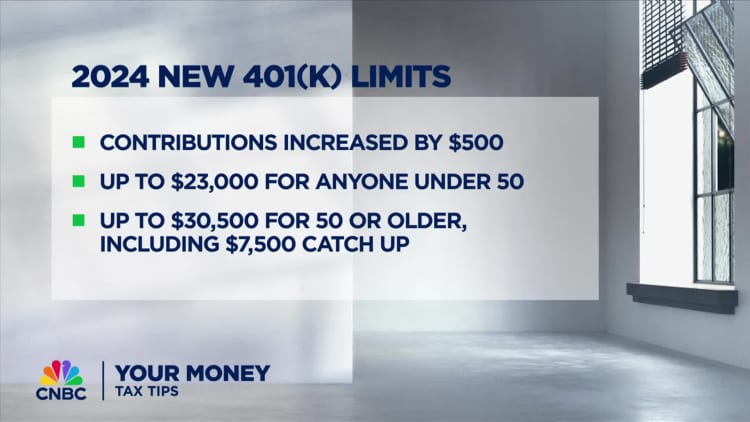

With 26 pay periods and a 20% contribution rate, you’ll reach the $23,000 employee deferral limit for 2024 after 15 payments and only get about $5,800 of your employer’s match.Â

In this scenario, you’d lose about $4,200 of the remaining 5% employer match by maxing out the plan early, according to Lucas. That $4,200 lost could be worth tens of thousands more in future growth

Typically, you can avoid the issue by spreading contributions evenly throughout the year, but you should monitor changes, such as raises or bonuses, he said.

Review your summary plan description

Before you set aside your 401(k) deferrals, it’s important to know if your plan is for real, experts say.

“That’s one of the things we investigate,” said CFP Dan Galli, owner of Daniel J. Galli & Associates in Norwell, Massachusetts.

Typically, the best place to look is the “contributions” section of your summary 401(k) plan description, which may or may not mention the feature, he said.

“It’s never going to be said, ‘There’s no truth to this plan,'” Galli said. But you can double-check with your company’s HR department to confirm, which might prompt the company to add a real feature in the future.

#lose #money #maxing #401k #plan #early #special #feature

Image Source : www.cnbc.com

Post Comment