A thoughtful reader thinks month-to-month comparisons of CPI and PCE are too tough for a Fed rate cut in July. Let’s investigate the claim.

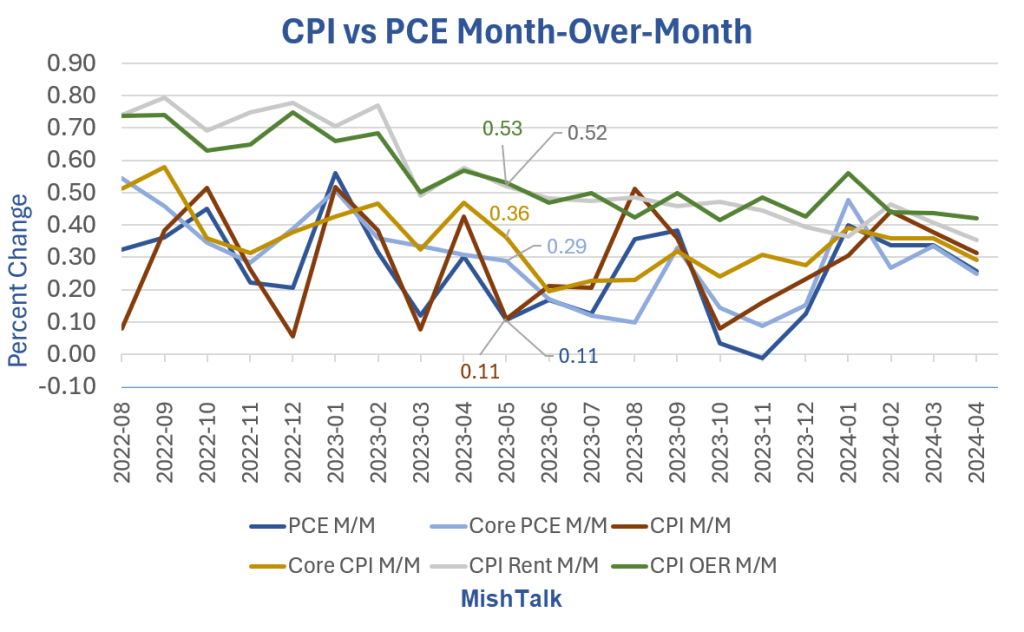

Chart notes

- The Consumer Price Index (CPI) numbers are from the BLS.

- OER means Owners Equivalent Rent. It’s the price someone who owns their home would pay if they rented instead.

- PCE stands for Personal Consumption Expenditure. The PCE price index is the Fed’s preferred gauge of inflation.

- CPI outperforms housing versus PCE.

- I calculated these numbers to two decimal places. BLS and BEA round to a single decimal place.

OER is the single largest component of the CPI with a weight of 26.64 percent. Rent has a weight of 7.62 percent, and the broader housing index has a weight of 36.16 percent.

Understanding my reader’s claim

The year-over-year CPI and PCE for May will decrease if the May numbers are lower than the previous year’s May numbers.

But will the Fed focus on core numbers or aggregate numbers?

Base numbers exclude food and energy.

Numbers to beat

- PCE: 0.11 percent

- Core PCE: 0.29 percent

- CPI: 0.11 percent

- Core CPI: 0.36 percent

- CPI Rent: 0.52 Percent

- CPI OER: 0.53 Percent

I agree with my reader that the core CPI and PCE numbers will be extremely difficult to beat. That’s why he thinks I’m two months early

But the Fed will be watching the underlying numbers more closely. And the base CPI numbers will depend on OER and Rent.

I think the Fed will be happy with a big improvement in either core CPI or core PCE. It also depends on the next two jobs reports and the unemployment rate.

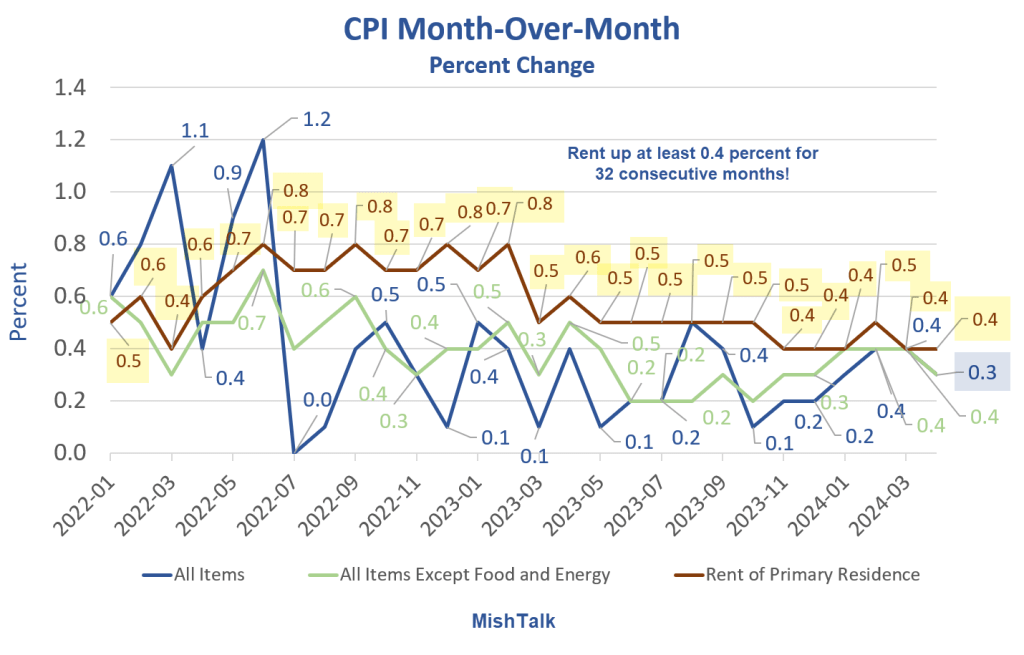

Rent and OER

Rent has increased at least 0.4 percent for 32 months.

For discussion, please see my post of May 15, 2024 CPI rose 0.3 percent with rent still rising steeply, food a bright spot

Yet another day of Groundhog for Rent

Rent for a primary residence, the cost that best equates to the rent people pay, rose another 0.4 percent in April. The rent of the primary residence has increased at least 0.4 percent for 32 consecutive months! [So has OER]

“Rents are falling” (or soon will) projections are based on the price of new rentals and cherry markets. But existing rents, far more important, continue to rise.

Only 8 to 9 percent of renters move each year. It has been a big mistake to think that new leases and completed construction will increase rental prices.

Most leases are renewed in May through August. I expect the rent to go down soon.

The last line above is the main one. Finally I think we see a decline in rental growth rates and OER. If not in May, then June.

But the Fed’s decision will also depend on Jobs’ reports for the next two months as well as economic data in general.

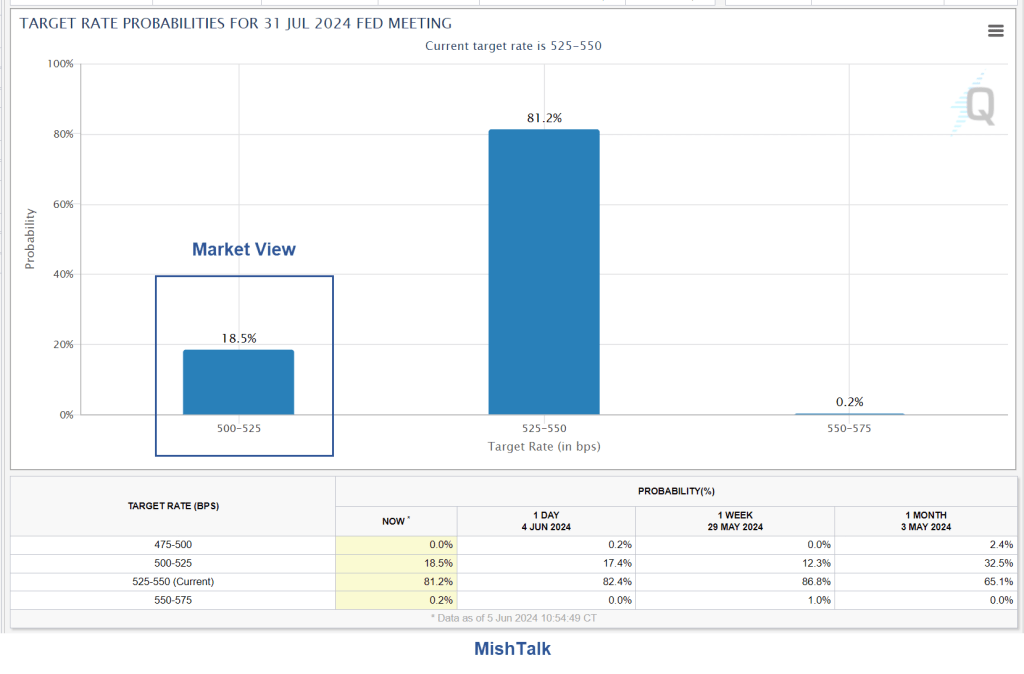

A July Fed rate cut is expected

For further discussion, please see I expect a Fed rate cut in July, despite the market’s view of an 18.5 percent chance

At the risk of sounding silly, I think the market is wrong about the chances of a Fed rate cut in July. What will it take?

To cut rates, the Fed will need a combination of weak jobs, rising unemployment and improving inflation year over year.

My reader may be right. If there is no rate cut in July, then look for one in September.

A week ago, the probability of a rate cut in September was only 46.9 percent. Now it is up to 70.6 percent!

A second quarter recession this year looks increasingly likely

This morning I commented A second quarter recession this year looks increasingly likely

As I look at the evolution of consumer spending, housing starts, new home sales and GDP trends Now, it appears the economy has peaked.

In the link above, I describe the many ways the economy is weakening.

My bet is that jobs reports will be subdued and/or that there will be enough improvement in OER and rent to support a rate cut.

There is an additional wild card. The Fed will make excuses to do whatever it wants to do.

If the Fed is looking to cut rates before the election, there are only two real chances, July and September. There are no Fed meetings in August or October.

#CPI #PCE #numbers #beat #support #Fed #rate #cut

Image Source : mishtalk.com